How to read your Explanation of Benefits

Whenever LifeWise processes a claim submitted by you or your healthcare provider, we explain how we processed it in the form of an Explanation of Benefits (EOBs).

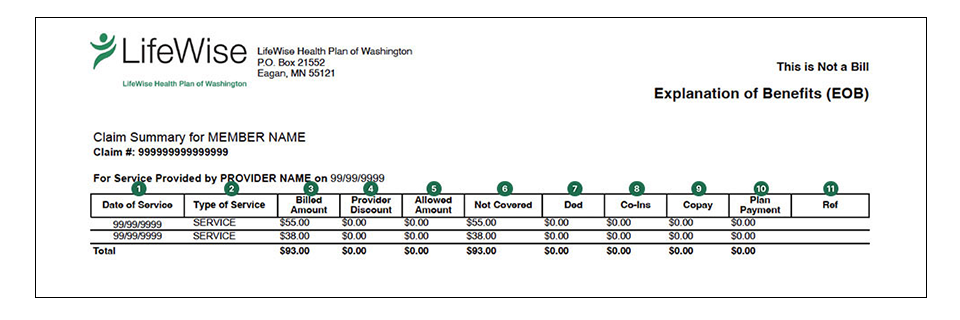

An EOB is not a bill. It’s simply a statement that explains how your benefits were applied to that claim. It includes the date you received the service, the amount billed, the amount covered, the amount we paid and any balance you’re responsible for paying the provider. It also tells you how much has been credited toward any required deductible.

Each time you receive an EOB, review it closely and compare it to the receipt or statement from the provider. To help in this task, here’s an explanation of the EOB form, item by item.

There’s a lot of information packed into the EOB. We organized it all so you can quickly find what matters most to you. Your EOB contains 3 items:

- A Claim Summary page that explains costs and claim detail using simple math. Now you’ll clearly know how much you owe a provider, how much you’ve paid on your deductible, and how much you saved as our member.

- An easy-to-use glossary page to help you understand health coverage terms.

- An updated EOB Claim Detail page (shown below). This should be used to confirm bills from your provider. It uses medical descriptions that make sense, so you don’t have to pull out a dictionary to figure them out.

Here’s how to read the updated EOB claim detail

We’ve explained the EOB item by item below to help you confirm bills from your provider, see how much of your own money you spent, and decide where you may be able to save money in the future.

EOB Key

- Date of Service – The date(s) service was provided.

- Type of Service – The type of service rendered.

- Billed Amount – The full amount the provider billed for services.

- Provider Discount – The amount the provider has agreed to write off and for which the member is not responsible.

- Allowed Amount – The amount approved for processing.

- Not Covered – The service(s) billed is/are not allowed under your plan.

- Ded (Deductible) – The amount that has been applied to the deductible under your plan.

- Co-ins (Co-insurance) – The amount that has been applied toward the % co-insurance under your plan.

- Copay (Co-payment) – The amount that has been applied to the co-payment under your plan.

- Plan Payment – The amount the plan paid for services.

- Ref – Under this column, the code shown is explained in the remarks section on your Explanation of Benefits (EOB) statement.

Customer service

If you have any questions regarding your EOBs or your benefits refer to your plan benefits booklet or call LifeWise Health Plan of Washington Customer Service toll free at 1-800-817-3056.

Sign up for paperless EOBs, save time and reduce clutter

With paperless statements from LifeWise, get 24/7 access to your EOBs, as well as invoices and your digital ID card. You can also pay bills online and set up automatic payments. Paperless statements from LifeWise are fast, reliable, secure, and free!

Sign up for a secure online account and opt in to paperless statements.